- Cibrano Nest Seekers

- Posts

- Fed Cuts Rates Again Amidst Uncertain Economic Data

Fed Cuts Rates Again Amidst Uncertain Economic Data

Employment, Inflation and CPI All Play a Role

The Weekly Recap

Good morning, happy Friday and happy Halloween! Our overlords at the Federal Reserve cut rates again another 25bps this week, the NYC mayoral race is coming to a head, M&A activity is surging, US and China struck a deal, a third of condo owners lost money on the sale of their homes in NYC in the last year, average household wealth has hit $1.3m in the US. CT home prices are soaring in anticipation of a Mamdani mayoralty and apparently Gen Z is over Chipotle and Shake Shack.

If you missed last weeks newsletter on NYC Real Estate Had a Strong September, you can read that through the link.

Fed Cuts Rates Again Amidst Uncertain Economic Data

Hiring has cooled in recent months and while that slowdown often hints at recessionary pressure, the broader economic picture remains surprisingly mixed. The headlines have been loud latelt: 30,000 job cuts at Amazon, significant layoffs at UPS, and Target trimming 8% of its corporate staff.

Yet beneath those attention grabbing announcements, the labor market has shown unexpected resilience. Goldman Sachs’ analysis of state-by-state figures indicates no meaningful rise in weekly jobless claims, which have remained near historic lows even as announced job cuts hit a five-year high.

If the economy were slipping into a full-blown downturn, we’d expect to see claims spike and manufacturing activity contract sharply. Instead, S&P’s latest flash PMI data revealed that both manufacturing and services expanded to three-month highs despite persistent tariff and cost pressures.

Job creation has slowed considerably, with just 27,000 positions added per month on average since May and BLS data revised down drastically from 2024 alongside one negative month marking the first in five years. Some of this reflects ongoing post-pandemic “right-sizing,” public sector pullbacks, and the growing impact of AI-driven efficiency.

Still, the cooling labor trend has a silver lining: it opens the door for a more accommodative Federal Reserve. That shift is precisely why Piper Sandler’s chief strategist, Michael Kantrowitz, who was recently named Wall Street’s top-ranked strategist for the second year in a row, remains constructive. After accurately calling the April market bottom with his “recession cancelled” call, he argues that easing financial conditions could help stabilize growth just as the data turns murky.

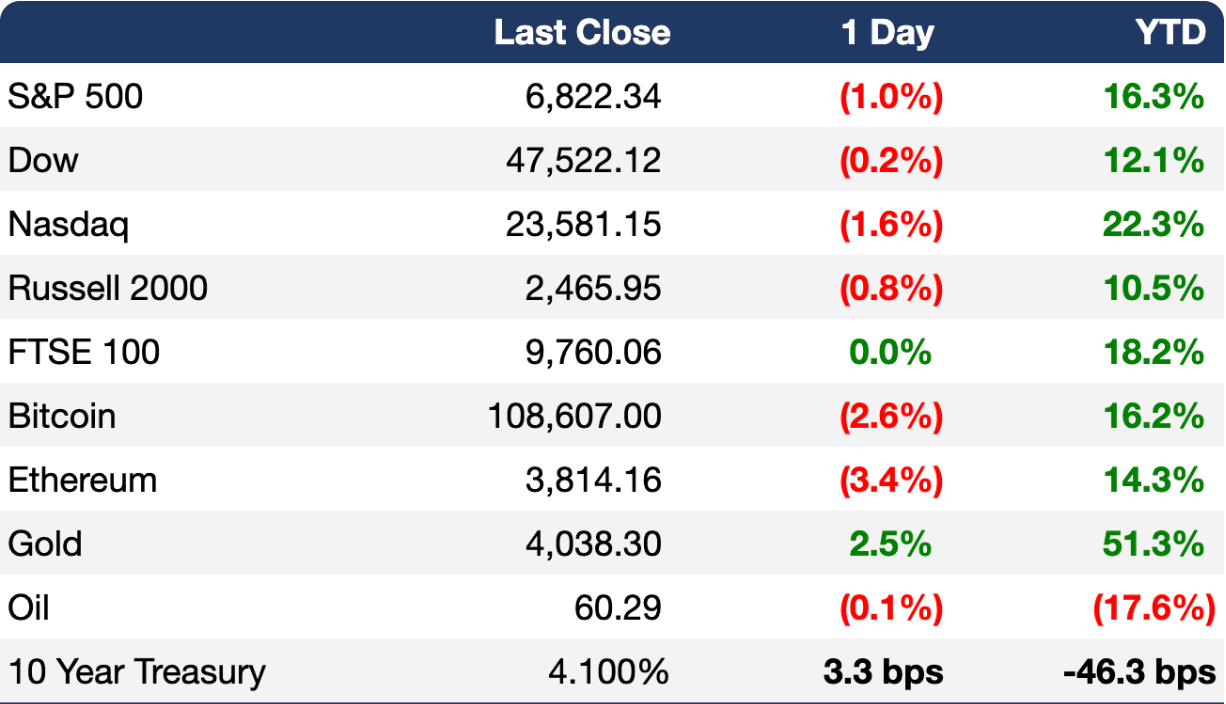

Market Performance

Here are how some other indexes and asset classes have performed as of this morning’s opening bell.

Source: ExecSum

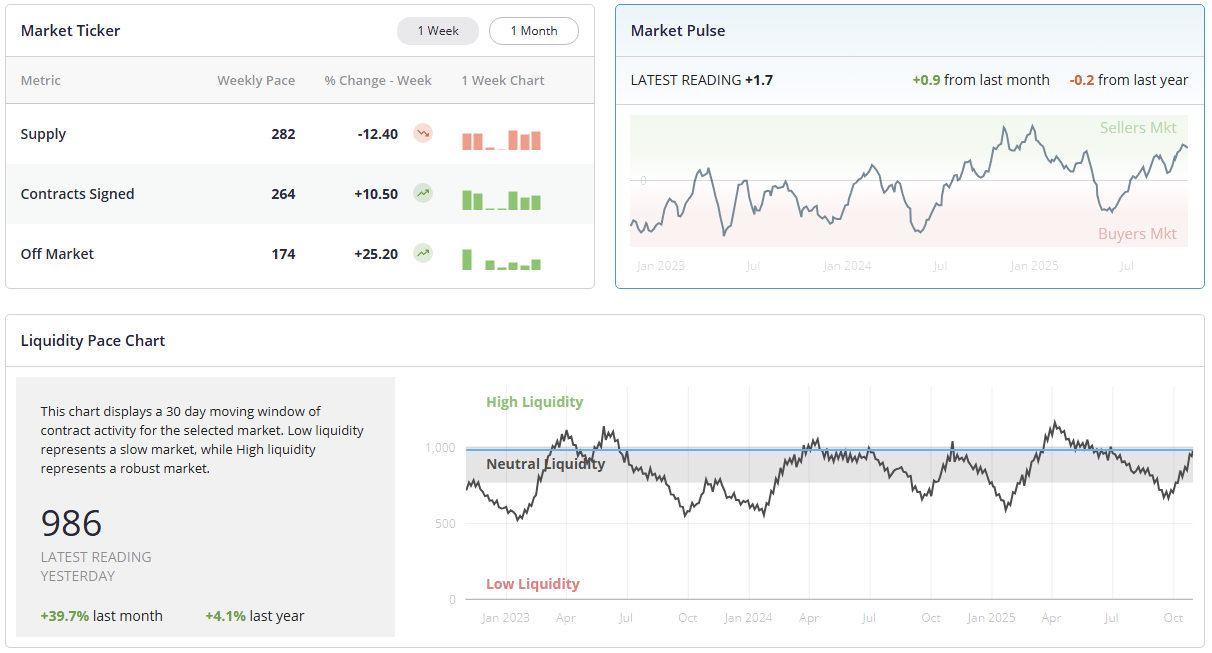

NYC Market Update

Here is a view of NYC market activity over the past week.

Source: UrbanDigs

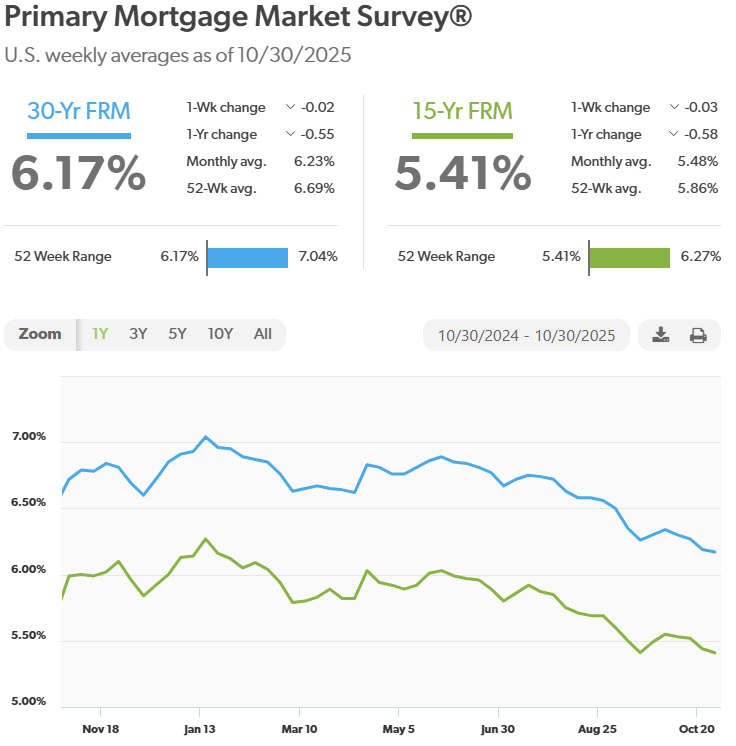

Mortgage Rate Update

Mortgage rates decreased for the fourth consecutive week. The last few months have brought lower rates and homebuyers continue to enter the market. With the Fed rate cuts this week, we should hopefully see a further dip in rates over the coming few weeks.

Source: FreddieMac

News You Can Use

Fed Cuts Rates Again, but Powell Raises Doubts About Easing At Next Meeting CNBC

Fed Cut Rates Again. No One Knows What Comes Next Bloomberg

One in Three Manhattan Condo Owners Lost Money When They Sold in the Last Year CNBC

Bidding Wars and Soaring Prices Hit Connecticut Homes Ahead of NYC Election Outcome NY Post

Inflation Rate Hit 3.0% in September, Lower Than Expected CNBC

How Affluent Investors Are Using Options Math to Borrow on the Cheap Bloomberg

US to Continue Dominating Global Investment Flows Reuters

Manhattan Continues Converting Offices to Housing at Record Clips NY Post

Global M&A Activity Up 10% in First Nine Months of 2025 Reuters

Bessent Lists Five Finalists for Fed Chair Job CNBC

US Companies Strike $80 Billion in Merges as Trump Boosts Deal Making Financial Times

NVIDIA CEO Downplays AI Bubble Fears as He Enlists New Partners Bloomberg

October Price Data Unlikely to Be Released Bloomberg

US, China Tee Up Sweeping Trade Deal for Trump, Xi to Finish Bloomberg

Chipotle, Shake Shack Warn of Trouble Among Young Consumers Bloomberg

The Deep Insight

Act

“The most difficult thing is the decision to act, the rest is merely tenacity.”

Contact Me

Feel free to reach out to discuss more in-depth about your real estate goals, share your thoughts about my newsletter, or to share what you're experiencing in this market. Looking forward to hearing from you!

Paul Cibrano | SVP, Managing Director

Licensed Associate Broker

Education Director Manhattan NAHREP

REBNY Member

View All of My Listings Here

Nest Seekers I N T E R N A T I O N A L

594 Broadway Suite 401, New York, NY 10012

25 Nugent St, Southampton, NY 11968

M. 631.948.0331

Websites: cibranonestseekers.com nestseekers.com

My Free E-Book: NYC and Hamptons Real Estate Guide For Clients