- Cibrano Nest Seekers

- Posts

- How is the NYC Real Estate Market?

How is the NYC Real Estate Market?

Not Your Normal Q1 Slowdown

The Weekly Recap

Good morning and happy Friday! The NYC market is hot even though it is still freezing outside. Crypto continues to get walloped in the markets, US banks are expecting more lending demand for 2026, US manufacturing is up, the Super Bowl is this weekend, the Winter Olympics have begun and the prices of avocados are down 19% so you no longer have to feel guilty about getting the Avocado Toast at brunch.

If you missed last weeks newsletter on What to Expect From the New Fed Chair Pick, you can read that through the link.

How Is the NYC Real Estate Market?

No matter what the headlines say about the market, my answer to that question always starts the same way: “It depends on which side of the transaction you’re on.” In a place as hyper-dynamic as New York City, it’s not enough to simply read today’s conditions, you have to interpret where the market is heading just as carefully as where it stands right now.

Buyers and sellers can be living in the very same moment yet experiencing two entirely different realities. What feels like hesitation on one side can feel like opportunity on the other. What looks like uncertainty in the data can actually be clarity when viewed through the right lens. That’s why understanding the market requires more than diagnosing current conditions; it requires taking a longer view and recognizing the directional signals beneath the surface noise. Here is how I am seeing the NYC market in the first five weeks of the year.

Rental Market: Renters who have been waiting for the historically slow times of the beginning of the year for price resets are going to be disappointed. With almost 90% of renters renewing leases and staying put in their homes, the market is still missing a lot of supply compared to the demand it is yielding. Rents aren’t loosening as they still sit much higher than the national average. The FARE Act has complicated issues where landlords no longer advertise available units and will lease them off market, keeping overall pricing sticky.

Buy Side: As rates decline, buyers who spent the past few years on the sidelines are stepping back into the marketplace. That wave of pent-up demand is already translating into multiple best-and-final situations, particularly in the sub-$1.5 million price point. As borrowing costs continue to ease, expect competition to intensify especially from all-cash buyers who can move quickly and decisively.

What’s notable is how concentrated this activity is. Many of these buyers are highly informed, financially prepared, and have been waiting patiently for the right combination of pricing and rate relief. The moment that window began to open, they moved with urgency. This is creating a dynamic where properly priced inventory doesn’t linger and is absorbed almost immediately.

While the upper tiers of the luxury market are moving at a more measured pace, well-positioned properties under $1.5 million are often transacting within days of hitting the market.

Sell Side: Sellers are firmly in the driver’s seat as limited supply continues to challenge most buyers entering the market. Those who are realistic and strategic with their pricing are seeing the benefits of that discipline, often moving their properties quickly and efficiently.

While price is the primary factor in whether a property sells, it’s far from the only one. Marketing, timing, and the right partnerships all play a critical role in how visible a listing becomes and how compelling it feels to buyers. Exposure and presentation can be just as influential as the number on the listing sheet.

There are few things more detrimental to a seller’s bottom line than prolonged days on market. The longer a property sits, the more negotiating power quietly shifts away from the seller and into the hands of buyers.

Market Performance

Here are how some other indexes and asset classes have performed as of this morning’s opening bell.

Source: ExecSum

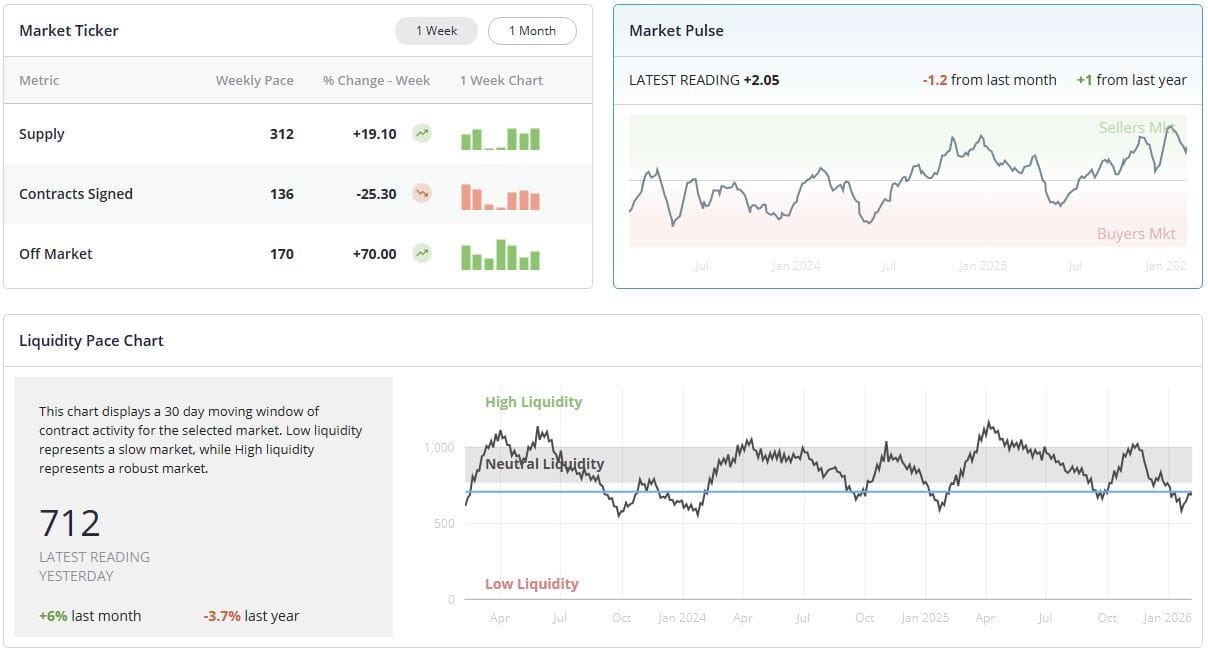

NYC Market Update

Here is a view of NYC market activity over the past week.

Source: UrbanDigs

Mortgage Rate Update

Over the last few weeks, mortgage rates remain near their lowest levels in years. The combination of improving affordability and the increase in the availability of new homes to purchase is a positive sign for buyers and sellers heading into the spring home sales season. This point last year, mortgage rates were 80 bps higher than they are today.

Source: FreddieMac

News You Can Use

The Housing Market Is Swinging Towards Buyers Wall Street Journal

Manhattan’s Luxury Market is Roaring Back to 2016 Levels NY Post

Builders Push ‘Trump Homes’ in Pitch for a Million New Houses Bloomberg

US Manufacturing Activity Expands by the Most Since 2022 Bloomberg

Affordable Housing Starts In the Labor Market Bloomberg

Bitcoin Dips Below $79,000 as Market Digests Silver Sell-Off, New Fed Pick CNBC

US Banks Expect Stronger Loan Demand in 2026, Fed Survey Shows Reuters

A Hawk or a Dove? Understanding New Fed Pick Kevin Warsh Bloomberg

Investors Ramp Up Bets on Steeper yield Curve Under a Warsh Led Fed Reuters

Fed Governor Miran Steps Down from White House CEA Role Bloomberg

Manhattan Retail Lease Rebounds Continue NY Post

NYC, NJ Business Groups Urge Trump to Restore Gateway Funds Bloomberg

NYC On Track for Longest Deep Freeze in 65 Years NY Post

Avocado Prices Are Coming Down Just In Time for Super Bowl Guacamole Bloomberg

The Deep Insight

Overcoming Failure

“The best way out is always through.”

Contact Me

Feel free to reach out to discuss more in-depth about your real estate goals, share your thoughts about my newsletter, or to share what you're experiencing in this market. Looking forward to hearing from you!

Paul Cibrano | SVP, Managing Director

Licensed Associate Broker

Education Director Manhattan NAHREP

REBNY Member

View All of My Listings Here

Nest Seekers I N T E R N A T I O N A L

594 Broadway Suite 401, New York, NY 10012

25 Nugent St, Southampton, NY 11968

M. 631.948.0331

Websites: cibranonestseekers.com nestseekers.com

My Free E-Book: NYC and Hamptons Real Estate Guide For Clients