- Cibrano Nest Seekers

- Posts

- How Do You Win A ‘Best and Final’ Offer Submission?

How Do You Win A ‘Best and Final’ Offer Submission?

The Weekly Recap

Good morning and happy Friday! It’s officially ‘deal with everything you pushed off to the new year’ season. Trump announced a move to ban institutional investors from buying single family homes while instructing Fannie Mae and Freddie Mac to buy mortgage debt. Manhattan office space is thriving and expensive while home sales in the borough also rose in Q4 driven by CO-OP sales. 40% of homeowners do not have a mortgage, the US trade deficit is the smallest since 2009, luxury watches on the secondary market are hitting new price highs and the food pyramid has been turned literally upside down.

New Year Brings Renewed Momentum to NYC Housing Market

One of the most misunderstood aspects of real estate markets is the difference between leading and lagging data.

Lagging data includes closed sales, average home prices, contract volume and tells us where the market has been. By the time it shows up in headlines or quarterly reports, the behavior that created it may already be weeks or even months old. Leading data, on the other hand, reflects what is happening right now: showing requests, inbound inquiries, seller consultations, listing preparation, and buyer engagement. This is the data that quietly signals where the market is headed next. Money moves way faster than information.

As we move through the first full week of the new year, the leading indicators are speaking clearly.

Now that the holiday season is behind us, activity has picked up tremendously. Within my role at Nest Seekers International I get a look into a large portion of our portfolio and agent activity. We’ve seen a noticeable increase in showing requests, renewed buyer outreach, and a surge in conversations with sellers preparing to bring listings to market. This is the annual reset in real time. Buyers are refocusing, sellers re-engaging, and decision-making accelerating after a period of pause.

More importantly, this pickup isn’t driven by headlines or macro narratives alone. It’s happening at the ground level. Calendars are filling. Properties that sat quietly through December are suddenly back in motion. Owners who used the holiday lull to plan are now executing and finalizing pricing strategies while positioning assets for early-year exposure.

This is why relying solely on lagging data can be misleading. By the time closed-sale statistics reflect renewed momentum, the opportunity for optimal positioning may have already passed. The early weeks of January often reward those who understand how markets transition, not just how they report.

For buyers, this means competition is beginning to re-enter the picture. It will happen gradually, but meaningfully. For sellers, it means the window to capture attention before inventory fully rebuilds is opening now. For investors, it underscores why disciplined observation of real time activity is just as important as long-term fundamentals.

Every market cycle has a moment where sentiment quietly shifts before the data confirms it. Based on what we’re seeing across showings, listings, and preparation activity, that shift is underway. As always, strategy matters more than timing alone. Understanding the signals beneath the surface is what allows clients to move decisively ahead of the curve.

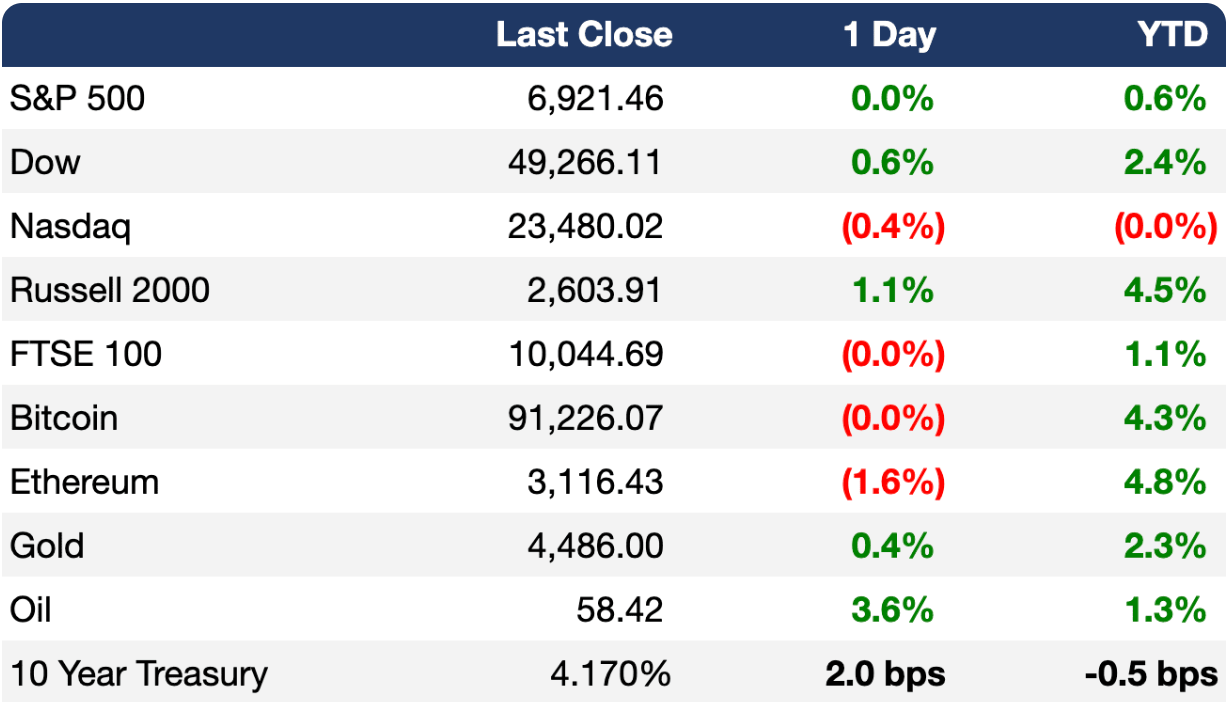

Market Performance

Here are how some other indexes and asset classes have performed as of this 12/31 morning’s opening bell.

Source: ExecSum

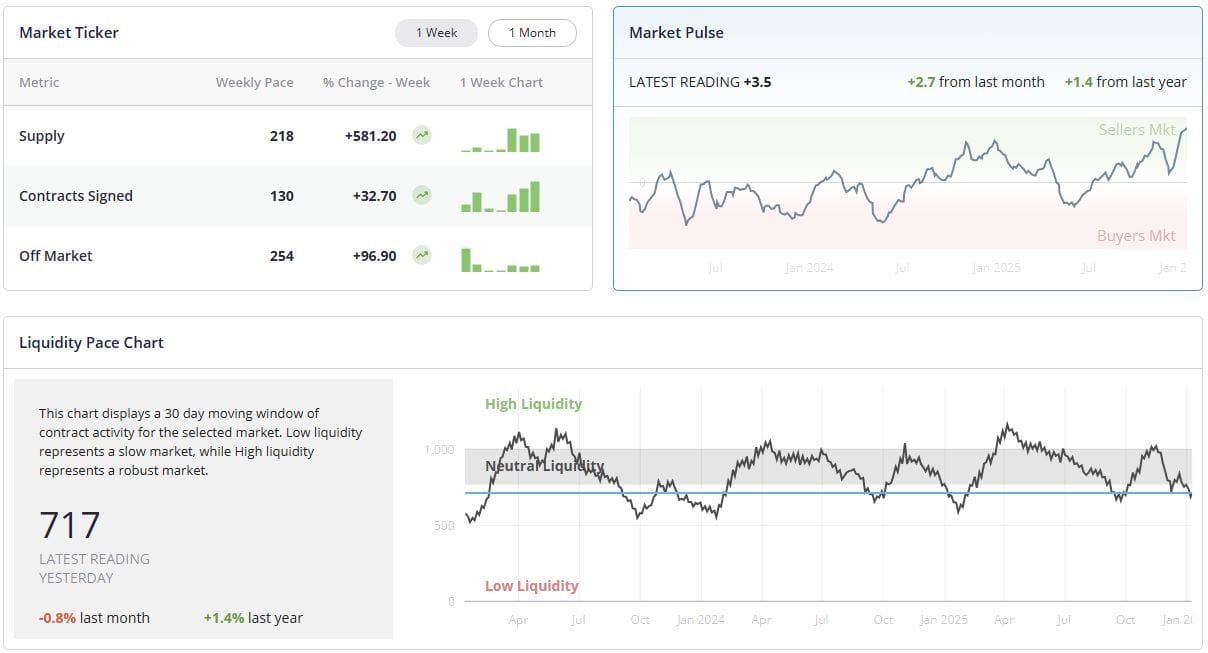

NYC Market Update

Here is a view of NYC market activity over the past week.

Source: UrbanDigs

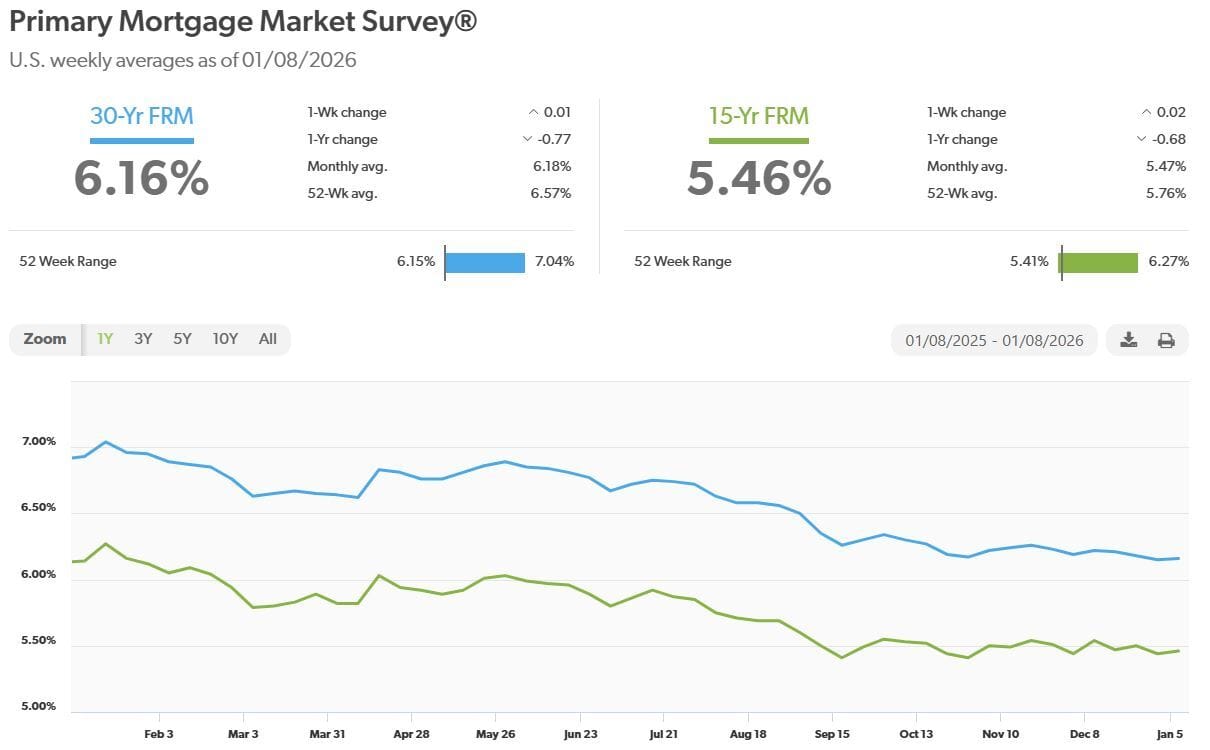

Mortgage Rate Update

The average 30-year fixed-rate mortgage remained essentially flat week over week, still hovering around the 6% mark. The combination of solid economic growth and lower rates has led to improving momentum in for-sale residential demand, with purchase applications up over 20% from a year ago.

Source: FreddieMac

News You Can Use

Manhattan Home Sales Rise, Juiced Up by Lower Mortgage Rates Bloomberg

‘Quiet Luxury’ Is Coming for the Housing Market Fortune

White House Moves to Ban Institutional Investors from Buying Single-Family Homes Financial Times

Trump Tells Fannie and Freddie to Buy $200 Billion of Mortgage Debt Bloomberg

Bankers Are Gearing Up for Another Onslaught of Monster Deals in 2026 Wall Street Journal

US Q3 Productivity Grew At the Fastest Pace in Two Years Reuters

Trade Deficit Hits the Smallest Margin Since 2009 After Tariffs Reduce Imports CNBC

US Asset Managers Break M&A Spending Record Financial Times

Manhattan Office Leasing in Q4 Was the Strongest in Six Years CNBC

Banks Snatch Up Mortgage Backed Securities That Notched Best Returns Since 2002 Bloomberg

Office Rents at Manhattan Skyscrapers Set to Reach New Heights in 2026 NY Post

NYC Taxis and Buses Pick Up Speed With Congestion Toll Bloomberg

US to Discuss Future of Greenland with Danish Officials Next Week Financial Times

US Flips Food Pyramid to Promote Protein, Cut Added Sugar Bloomberg

Luxury- Watch Prices Hit a Two-Year High in the Secondary Market Bloomberg

The Deep Insight

Choices

“Destiny is no matter of chance. It is a matter of choice. It is not a thing to be waited for, it is a thing to be achieved.”

Contact Me

Feel free to reach out to discuss more in-depth about your real estate goals, share your thoughts about my newsletter, or to share what you're experiencing in this market. Looking forward to hearing from you!

Paul Cibrano | SVP, Managing Director

Licensed Associate Broker

Education Director Manhattan NAHREP

REBNY Member

View All of My Listings Here

Nest Seekers I N T E R N A T I O N A L

594 Broadway Suite 401, New York, NY 10012

25 Nugent St, Southampton, NY 11968

M. 631.948.0331

Websites: cibranonestseekers.com nestseekers.com

My Free E-Book: NYC and Hamptons Real Estate Guide For Clients