- Cibrano Nest Seekers

- Posts

- The Great Housing Reset

The Great Housing Reset

The 2026 Housing Market Will Look Very Different than 2025

The Weekly Recap

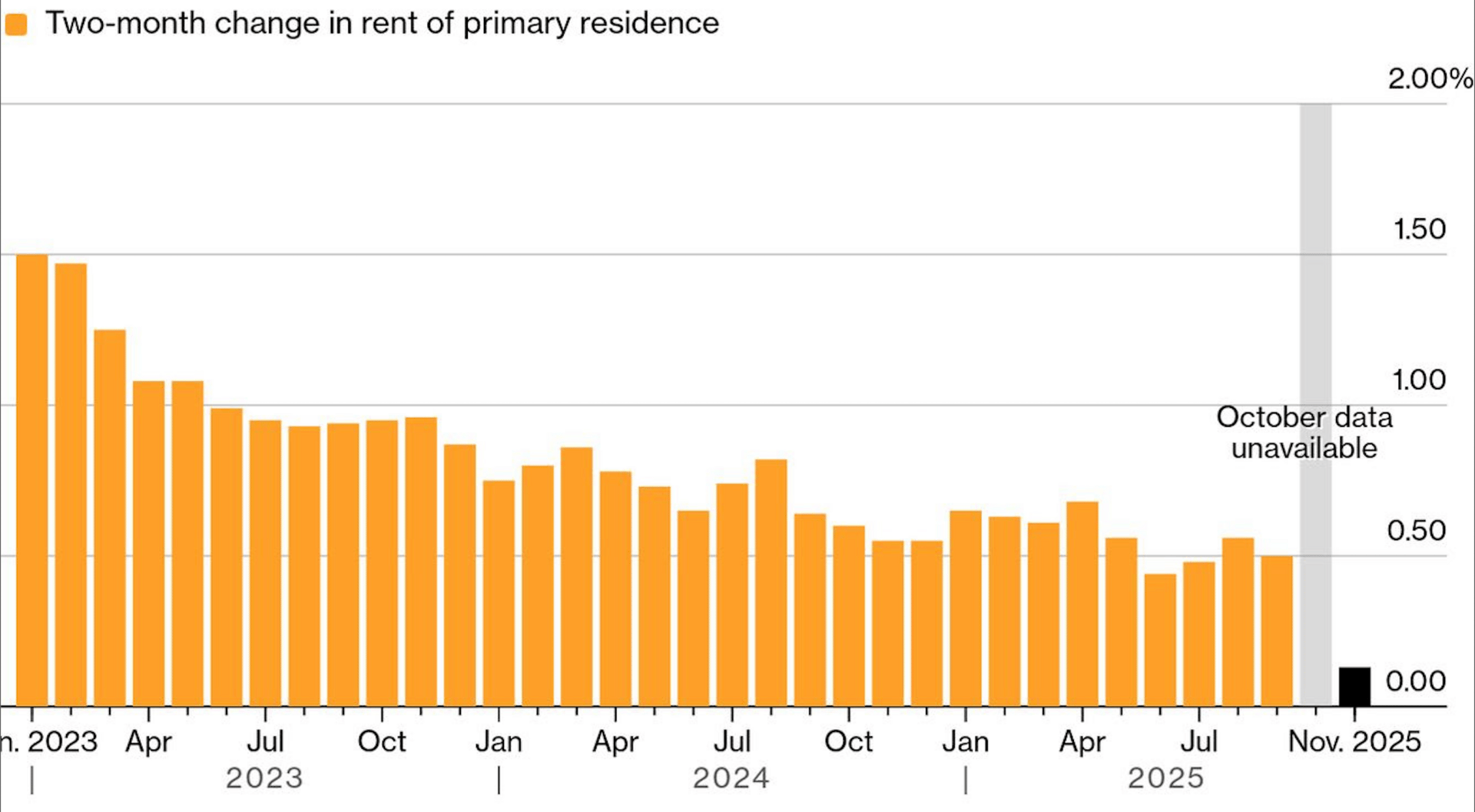

Good morning and happy Friday! Its almost ‘lets circle back’ in the New Year season, a home at 80 Clarkson just went into contract for $129 million the first 9 figure deal in the history of downtown NYC. Rental inflation is down MoM and YoY as overall inflation unexpectedly cooled in November. Wall Street saw its 2nd best year in the last 25 with over $4.5 Trillion in M&A activity for 2025. Oil has hit a four year low, Google will now be competing with Zillow by advertising homes and the unexpected neighborhood with new restaurant hot spots is Hudson Yards.

If you missed last weeks newsletter Federal Reserve Cut Rates Again and Announced an Unexpected Move, you can read that through the link.

The Great Housing Reset

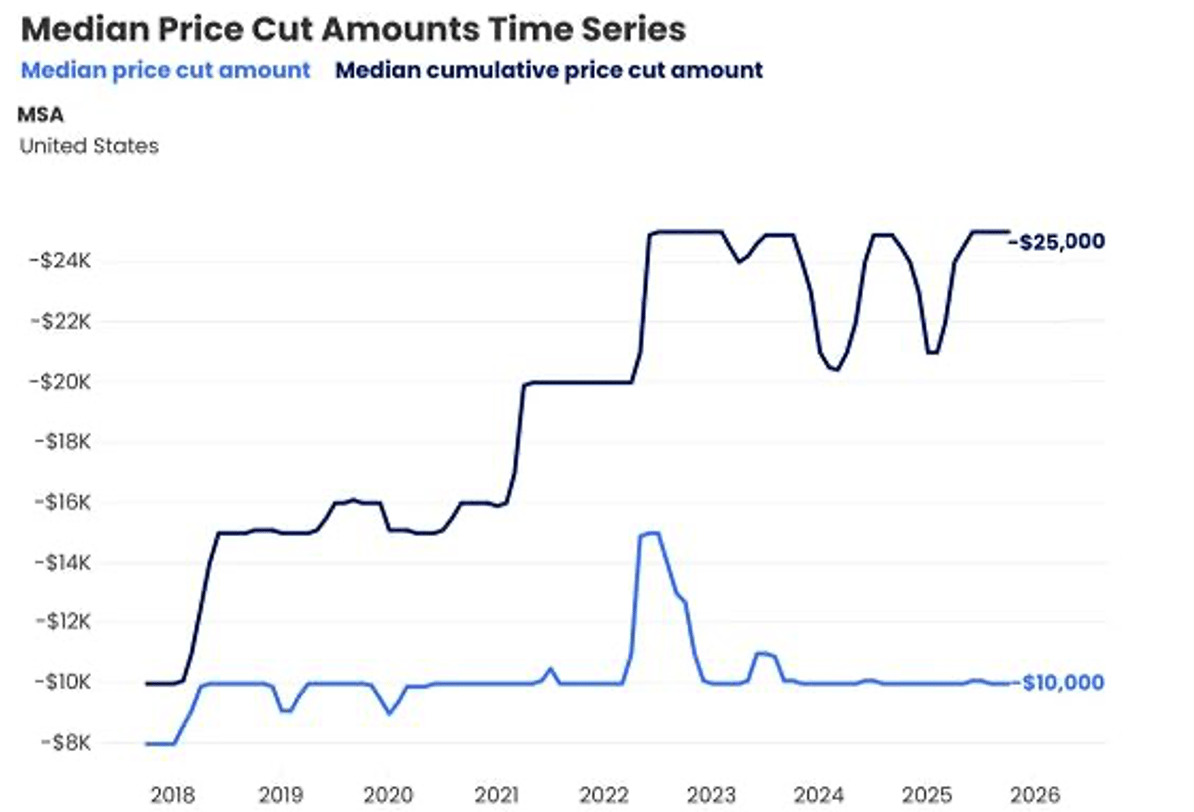

For the past two years, buyers have been forced to recalibrate their expectations around higher borrowing costs, tighter affordability, and a slower pace of decision-making. Now, the adjustment baton is being passed. Sellers are increasingly confronting a new reality as well, pricing power is no longer guaranteed. The market isn’t broken, it’s resetting. For sellers understanding this shift is the difference between stalled listings and successful closings. These price corrections and shifts to the marketplace are having downstream effects on other aspects of real estate.

Source: Zillow

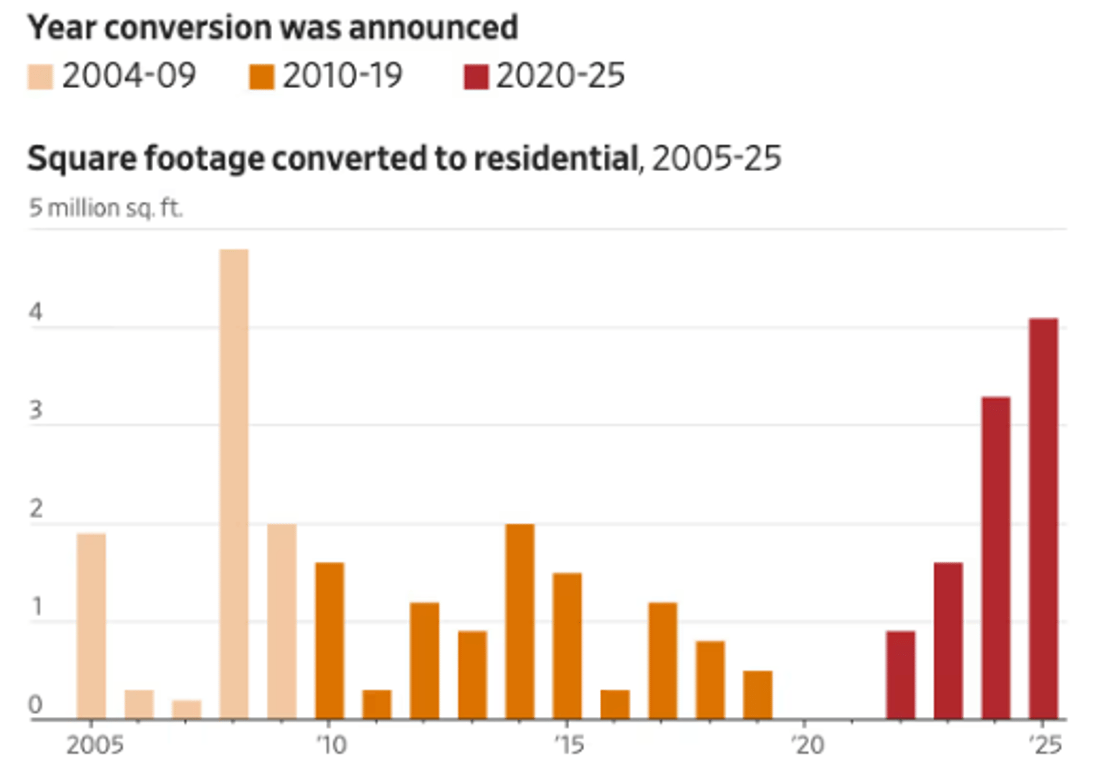

Nowhere is this reset more visible than in commercial-to-residential conversions. After the pandemic reshaped work, office vacancy surged to over 20%, up from just 11.1% in 2019, according to Cushman & Wakefield. In response, state legislators approved new tax abatements last year to accelerate conversions. As many as 25 future office conversion projects, totaling roughly 8.8 million square feet, are already in planning stages across Manhattan, signaling a structural rebalancing of supply rather than a temporary disruption.

Source: Bloomberg

On the residential rental side, supply dynamics are sharing similar sentiments as national multifamily vacancy hit 7.2% in November, the highest level on record. While the historic construction surge of recent years is slowing, a substantial pipeline of new units continues to deliver into a market facing softer demand. This imbalance is forcing landlords and investors to rethink pricing, concessions, and long-term assumptions.

Source: Bloomberg

This reset is also playing out beyond housing. In 2025, dealmaking surged across global M&A markets as companies, private equity, and family offices leaned into repricing opportunities created by volatility. As valuations normalized and capital markets stabilized, strategic buyers stepped back in with conviction, driving a sharp rebound in transaction volume. That resurgence in M&A activity underscores a broader theme, that periods of reset don’t freeze capital, they redirect it. This signals renewed confidence among sophisticated players and smart money who view transitional markets as moments to deploy, not retreat.

The Great Housing Reset is about normalization. Supply is finding equilibrium, pricing is becoming more rational, and opportunity is emerging for those who adapt early. Buyers, Sellers and Investors who position themselves as market interpreters rather than market wanderlusts will win in the short, medium and long term. In a reset, those who thrive are the ones who evolve with it.

Market Performance

Here are how some other indexes and asset classes have performed as of this morning’s opening bell.

Source: ExecSum

NYC Market Update

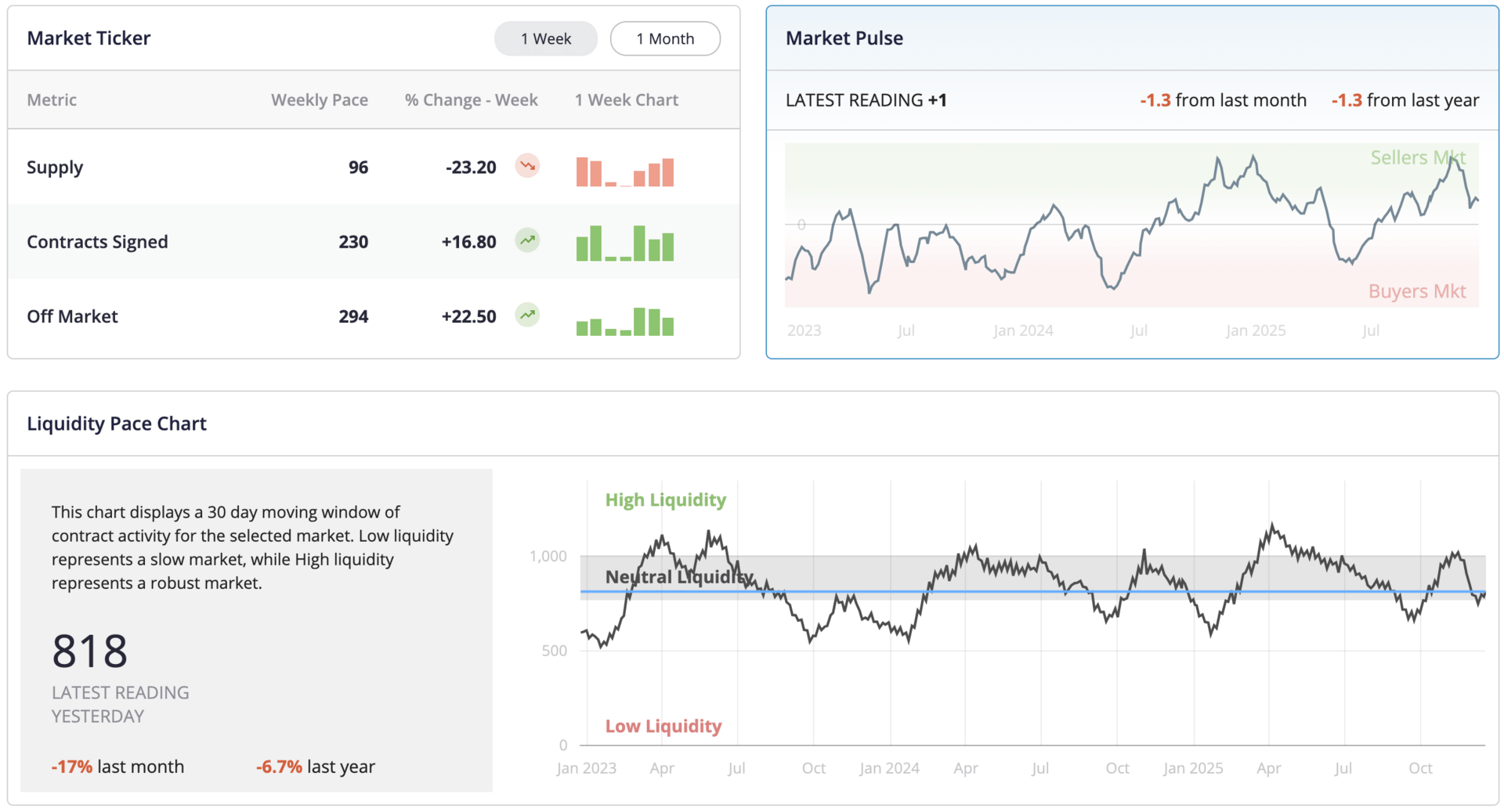

Here is a view of NYC market activity over the past week.

Source: UrbanDigs

Mortgage Rate Update

The average 30-year fixed-rate mortgage has remained within a narrow 10-basis point range over the last two months. With rates down half a percentage point over the last year, purchase applications are up 10% above the same time one year ago.

Source: FreddieMac

News You Can Use

Bond Market Debate Over Fed’s Path in 2026 About to Heat Up Bloomberg

Fed Decisions Distorted By ‘Phantom Inflation’ Financial Times

Zillow Shares Get Crushed as Google Announces Home Searching Options CNBC

Warner Brothers is Blockbuster Finale to $4.5 Trillion M&A Haul Bloomberg

Oil Prices Fall to Four-Year Low Below $55 a Barrel Yahoo Finance

Wall Street’s AI Adoption Is Set to Drive Hiring Boom, For Now Bloomberg

JP Morgan Pulls $350 Billion from Federal Reserve to Buy Up Treasuries Yahoo Finance

NYC’s Hudson Square Is Home to a Thriving New Restaurant Scene NY Post

Downtown Just Saw its First $100 Million Plus Home Sale in History NY Post

The Deep Insight

Self

“The only limit to our realization of tomorrow, will be our doubts of today.”

Contact Me

Feel free to reach out to discuss more in-depth about your real estate goals, share your thoughts about my newsletter, or to share what you're experiencing in this market. Looking forward to hearing from you!

Paul Cibrano | SVP, Managing Director

Licensed Associate Broker

Education Director Manhattan NAHREP

REBNY Member

View All of My Listings Here

Nest Seekers I N T E R N A T I O N A L

594 Broadway Suite 401, New York, NY 10012

25 Nugent St, Southampton, NY 11968

M. 631.948.0331

Websites: cibranonestseekers.com nestseekers.com

My Free E-Book: NYC and Hamptons Real Estate Guide For Clients