- Cibrano Nest Seekers

- Posts

- What Is the Future for Interest Rates?

What Is the Future for Interest Rates?

Trump vs. the Federal Reserve Is A Power Struggle

The Weekly Recap

Good morning and happy Friday! The Fed is split over how tariffs will impact inflation and their decision making for lowering rates. Both Manhattan rents and Bitcoin hit a new record high this week, Elon Musk started a new political party, NYC art schools are seeing application numbers hit record high, even Olivia ‘Livvy’ Dunne can get turned down by a NYC CO-OP board and a small miracle occurred, you’re now able to wear your shoes again while going through TSA.

What Is the Future of Interest Rates?

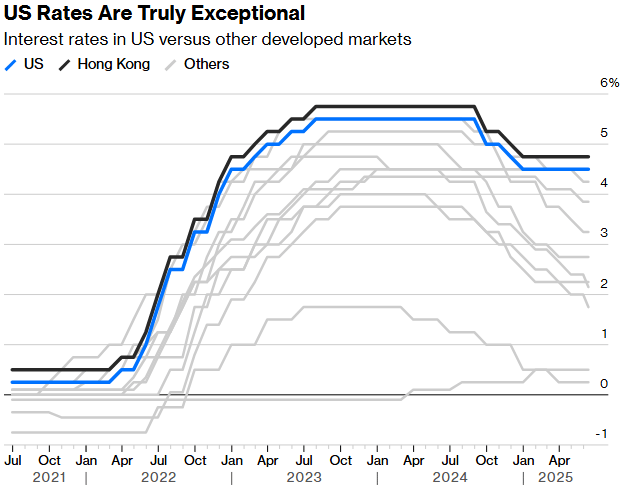

President Trump is once again pressuring Federal Reserve Chair Jerome Powell to lower interest rates, arguing that high borrowing costs are stifling economic momentum. Despite the U.S. economy showing signs of resilience, the federal funds rate remains among the highest in the developed world, giving concern that elevated rates could weigh on credit markets, real estate, and consumer spending. Trump contends that a rate cut is necessary (as much as 300bps worth of cuts) to maintain America’s competitive edge and stimulate investment, especially as other central banks around the world begin easing policy.

While the Fed maintains its independence and points to persistent inflationary pressures as justification for holding rates steady, the political heat is increasing as global comparisons place U.S. rates near the top among advanced economies.

Source: Bloomberg

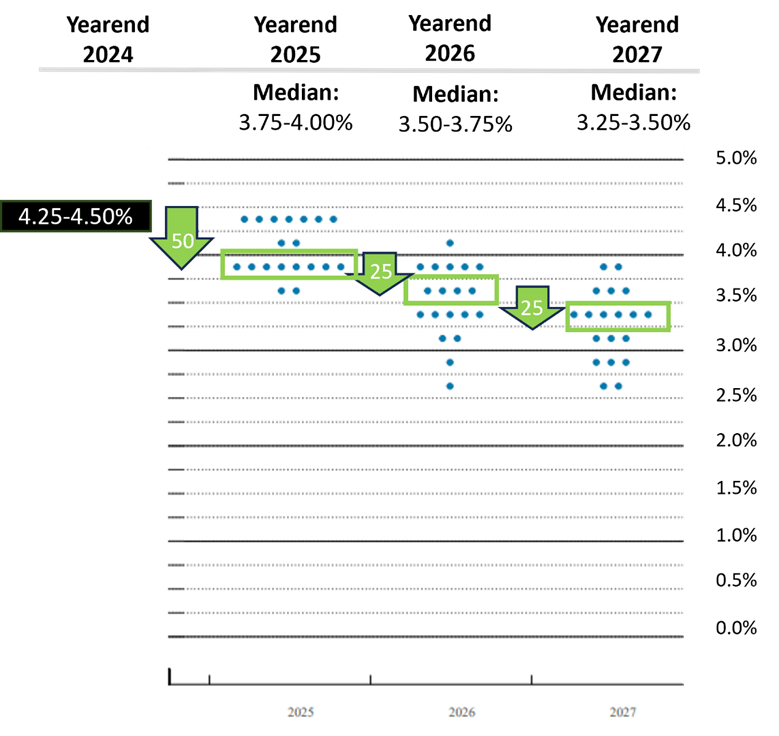

The June 2025 Federal Reserve dot plot projects a total reduction of 50 basis points in the federal funds rate over the course of 2025, followed by a further 25 basis point cut in 2026. Despite these projected rate cuts, the Fed expects inflation to remain elevated, largely due to the perceived impact of tariffs. The Fed has Core PCE inflation projected to end 2025 at 3.0% even though it has been trending downward and has not been hit by tariffs as hard as first thought. That projection which is 30 basis points higher than the forecast made on March 19. The Fed does not anticipate a return to near 2% PCE inflation until the end of 2027 which has been a point of contention internally within the Fed as most recent minutes show Fed governors split on that time horizon.

Meanwhile, the Federal Reserve continues to reduce its balance sheet. As of June 9, 2025, it had trimmed its securities holdings by $2.3 trillion from a peak of $9 trillion reached in April 2022.

Source: FOMC

While the Fed remains cautious, there are growing signs that the path toward lower interest rates is beginning to take shape. With inflation showing gradual signs of easing and global central banks shifting toward more accommodative policies, the conditions for rate cuts are steadily aligning. The projected reductions in 2025 and 2026, although modest, signal a turning point that could provide meaningful relief to credit markets by unlocking greater investment activity which would reinvigorate sectors like real estate. As the data evolves, the outlook for a more favorable rate environment is becoming increasingly likely.

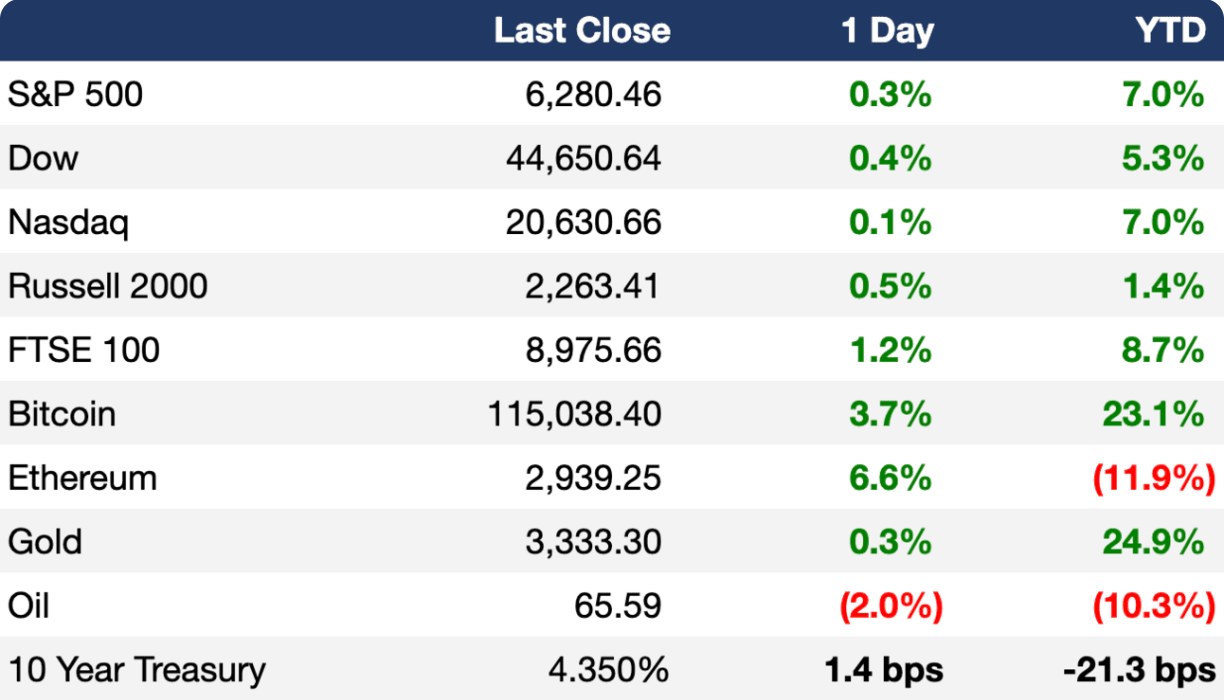

Market Performance

Here are how some other indexes and asset classes have performed as of this morning’s opening bell.

Source: ExecSum

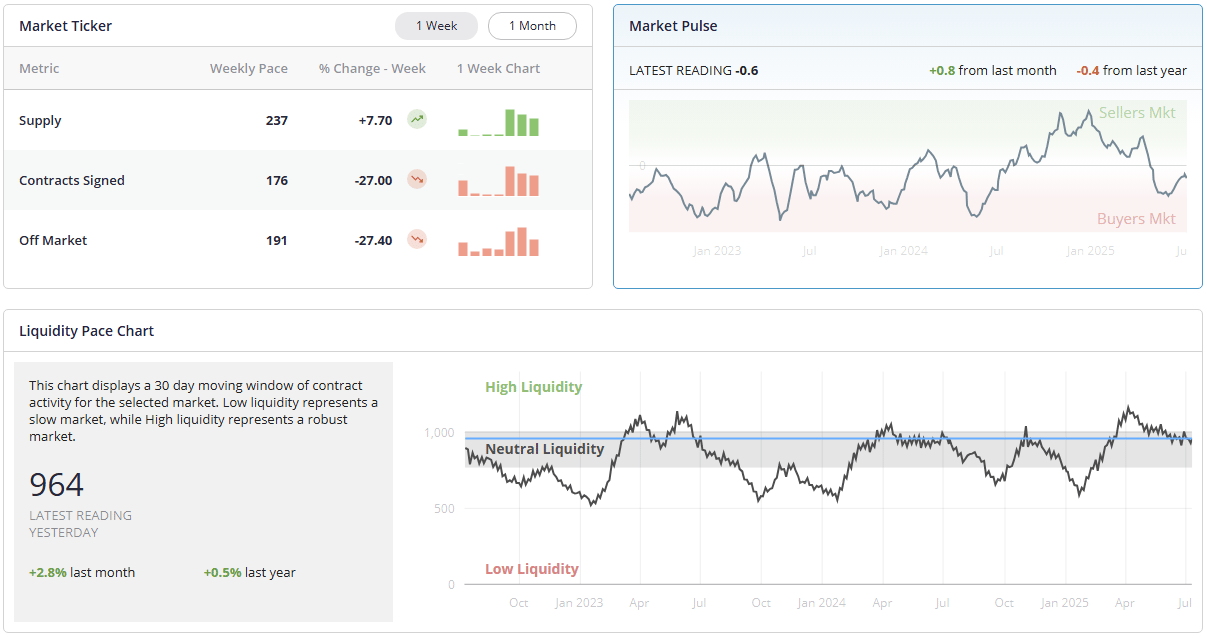

NYC Market Update

Here is a view of NYC market activity over the past week.

Source: UrbanDigs

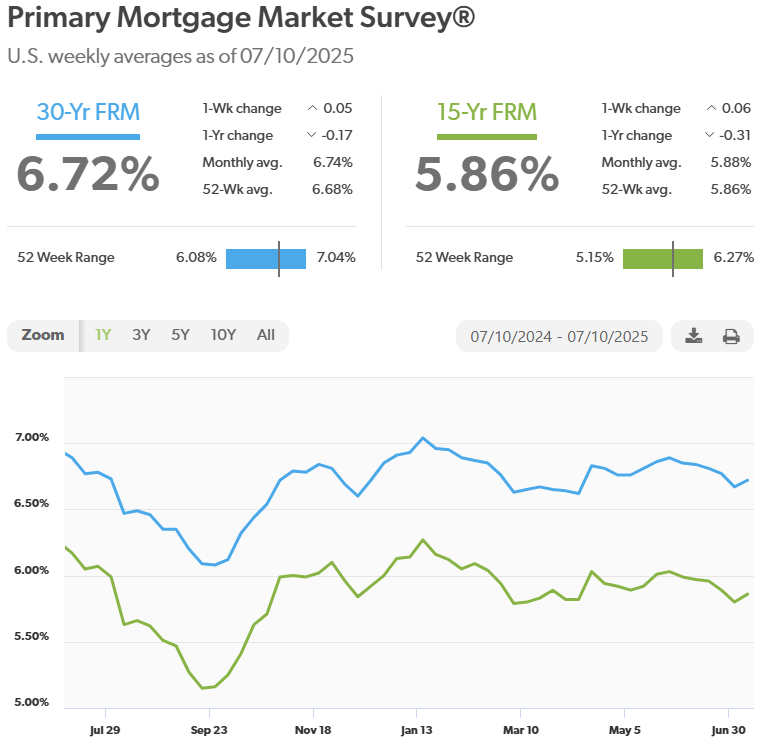

Mortgage Rate Update

The average 30-year fixed-rate mortgage ticked up slightly this week after five consecutive weeks of drops following a stronger than expected jobs report. Despite some affordability challenges, home purchase and refinance applications are responding to the downward movement of rates, increasing by 25% and 56%, compared to the same time last year.

Source: FreddieMac

News You Can Use

Manhattan Rents Hit Another Record With More Increases to Come Bloomberg

NYC Renters Are Scrambling for Shelter this Summer NY Post

Bitcoin Breaks $112,000 in First as Traders Defy Tariff Angst Bloomberg

Stocks Are Approaching Manic Levels, But Advisers Say It’s Not Too Late to Buy Bloomberg

First Time Home Buyers Are MIA. Landlords Are the Winners Wall Street Journal

Rent Rewards Startup Bilt Gears Up for Roughly $10B Valuation Axios

Saudi Fund Invests Hundreds of Millions in Proposed NYC Skyscraper Wall Street Journal

Fed Minutes Show Policymakers Split on How Tariffs Might Impact Inflation Bloomberg

Trump Says US Interest Rate is At Least 3 Points Too High Reuters

US Payrolls Increased by 147,000 in June, More than Expected CNBC

NYC Real Estate Dealmakers Brace for Drag-Out Battle with Mamdani’s Socialist Policies NY Post

NYC Art Schools See Record High Applications As Gen Zers Clambor to Enroll Gothamist

Even Livvy Dunne is Too ‘Sparkly’ For NYC CO-OP Board NY Post

You’ll Be Able To Wear Your Shoes Through TSA Effective Immediately USA Today

The Deep Insight

Learning

“The more that you read, the more things you will know. The more that you learn, the more places you’ll go.”

Contact Me

Feel free to reach out to discuss more in-depth about your real estate goals, share your thoughts about my newsletter, or to share what you're experiencing in this market. Looking forward to hearing from you!

Paul Cibrano | SVP, Managing Director

Licensed Associate Broker

Education Director Manhattan NAHREP

REBNY Member

View All of My Listings Here

Nest Seekers I N T E R N A T I O N A L

594 Broadway Suite 401, New York, NY 10012

25 Nugent St, Southampton, NY 11968

M. 631.948.0331

Websites: cibranonestseekers.com nestseekers.com

My Free E-Book: NYC and Hamptons Real Estate Guide For Clients