- Cibrano Nest Seekers

- Posts

- Why the Jobs Number Revisions Were a Gut Punch to Real Estate

Why the Jobs Number Revisions Were a Gut Punch to Real Estate

Rates Should Have Been Cut Months Ago

The Weekly Recap

Good morning and happy Friday! Mortgage rates hit their lowest levels since April, the Fed is angsty in wanting to cut rates, NYC area was hit with two earthquakes in a three day span. US consumer sentiment hit a five month high on stock market rally, Canada’s inability to maintain healthy forest shrubbery is impacting NYC air quality. All cash deals continue to be a driving force in NYC real estate with 60% of deals over the last five months being just that. Gowanus is being hailed the new Williamsburg and Instagram launches a terrifying new tracking feature.

If you missed last weeks newsletter on A Cold Housing Market In a Hot Economy, you can read that through the link.

Why the Jobs Number Revisions Were a Gut Punch to Real Estate

As a stark reminder of how quickly news and metrics can reshape market sentiment, the Labor Department released substantial downward revisions to recent job numbers this past week. This update highlighted that employment gains were overstated for several months, a reality that has contributed to a distorted macroeconomic Fed narrative. While there was some controversy around President Trump’s firing of the Bureau of Labor Statistics Commissioner Erika McEntarfer, the larger issue remains that inaccurate or outdated economic data continues to influence monetary policy at the highest levels.

Federal Reserve Chair Jerome Powell has repeatedly emphasized the strength of the U.S. labor market as a key reason the central bank has remained cautious on rate cuts. In the most recent Federal Open Market Committee (FOMC) minutes, Fed officials said:

“Participants observed that the economy had remained resilient, with solid consumer spending and a strong labor market…”

This resilience reflected in what were believed to be robust job reports as one of the core justifications for keeping rates elevated. As Powell stated in the post-meeting press conference:

“We need to see more evidence that inflation is moving sustainably toward 2 percent, and the labor market has remained strong, reducing urgency to adjust policy prematurely.”

But now, with the revised employment figures painting a less rosy picture, the rationale for holding rates steady was built upon poor fundamentals and a shaky foundation. The minutes even acknowledged the balancing act the Fed faces, stating:

“Some participants emphasized the importance of being prepared to respond promptly if labor market conditions were to weaken.”

Which hopefully means that come the September meeting, the Fed will be aggressive in reducing rates at least 50bps. This is especially relevant for the housing sector. The Fed’s rate stance has effectively kept first-time buyers sidelined, with high borrowing costs locking them into rental markets. This has driven up demand (and prices) in an already undersupplied environment for renters. At the same time, sellers, many of whom are locked into sub-4% mortgage rates, have little incentive to list, exacerbating inventory shortages.

Source: Bloomberg

If the revised labor data gains more traction among policymakers, it should absolutely shift the Fed’s calculus going into Q4. Even more frustrating, is that shelter costs continue to be a huge driver of inflation as it accounts for more than 60% of the rise in inflation compared to only about 20% at its post pandemic peak. Shelter rose by 0.2% month-over-month in June, making it the primary driver of the overall 0.3% increase in the Consumer Price Index (CPI) for all items. All economic data is intertwined and when bad data informs bad decision making its bad for all of us.

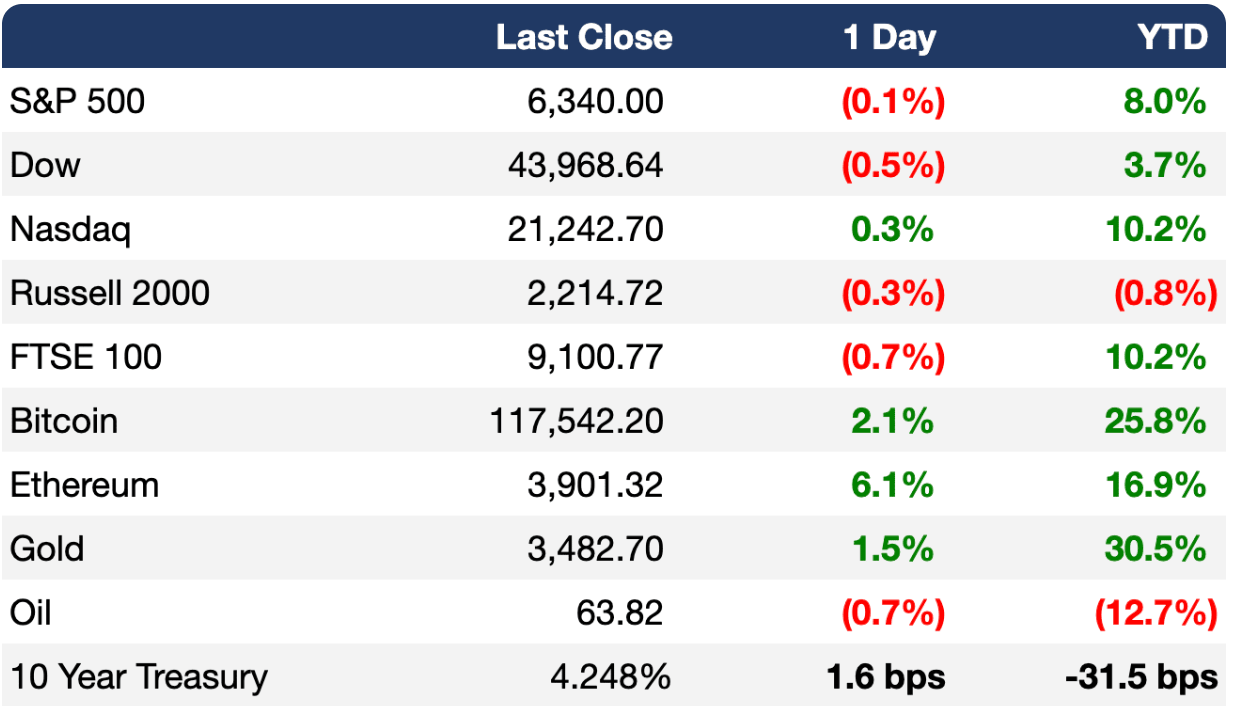

Market Performance

Here are how some other indexes and asset classes have performed as of this morning’s opening bell.

Source: ExecSum

NYC Market Update

Here is a view of NYC market activity over the past week.

Source: UrbanDigs

Mortgage Rate Update

The average 30-year fixed-rate mortgage dropped to its lowest level since April. The decline in rates has increased prospective buyers purchasing power. Freddie Mac research has shown that buyers that rate shop can save thousands by getting quotes from different lenders.

Source: FreddieMac

News You Can Use

How To Help Your Child Buy or Inherit a Home Bloomberg

Fed Policymakers Signal Rising Angst for Not Cutting Rates Reuters

60% Of Homes In Manhattan Over the Last Five Months Were Sold All Cash NY Post

NYC Air Quality Drops as Canada Fire Smoke Swirls South Bloomberg

Blackstone Staff Return to Park Avenue Office a Week After Tragedy Bloomberg

Busiest Week of M&A Dealmaking Since 2021 Has Bankers Scrambling Wall Street Journal

Biggest Job Revisions Since 2020 Expose Pitfall of Economic Data Bloomberg

US Consumer Sentiment Rises to Five-Month High on Stocks Rally Bloomberg

Second Earthquake Hits NYC Region Within Several Days AP

Wall Street Bonuses Are Set to Rise in 2025 Bloomberg

The Rise of the Next Williamsburg: Gowanus 6sqft

How to Turn Your Instagram Tracking for Friends On or Off Mashable

12 Completely Free and Pretty Fun Things to Do in NYC in August Gothamist

The Deep Insight

Change

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.”

Contact Me

Feel free to reach out to discuss more in-depth about your real estate goals, share your thoughts about my newsletter, or to share what you're experiencing in this market. Looking forward to hearing from you!

Paul Cibrano | SVP, Managing Director

Licensed Associate Broker

Education Director Manhattan NAHREP

REBNY Member

View All of My Listings Here

Nest Seekers I N T E R N A T I O N A L

594 Broadway Suite 401, New York, NY 10012

25 Nugent St, Southampton, NY 11968

M. 631.948.0331

Websites: cibranonestseekers.com nestseekers.com

My Free E-Book: NYC and Hamptons Real Estate Guide For Clients